The post-election optimism that had surged through U.S. business circles—driven by promises of deregulation and tax cuts—has swiftly faded over the past month. A combination of DOGE-fueled federal spending cutbacks and a volatile trade policy, punctuated by the April 2nd announcement of reciprocal tariffs on all global trade partners, has unnerved markets and left corporate leaders seeking direction. Until there’s greater clarity on trade, corporate America remains in a holding pattern, waiting for the rules of engagement to be defined.

Hard vs. Soft Data: A Tale of Two Economies

As of March, the “hard” economic data continues to show strength: unemployment remains near historic lows, and inflationary pressures, while still present, are gradually easing. From the Federal Reserve’s perspective, this economic backdrop supports the current interest rate posture. Federal Reserve Bank of New York President John Williams recently echoed this sentiment:

“The current modestly restrictive stance of monetary policy is entirely appropriate given the solid labor market and inflation still above our 2% goal.”

However, hard data is by nature backward-looking. It doesn’t yet reflect the potential downstream effects of recent policy shifts. Meanwhile, “soft” data—surveys that capture consumer sentiment—tells a much different story.

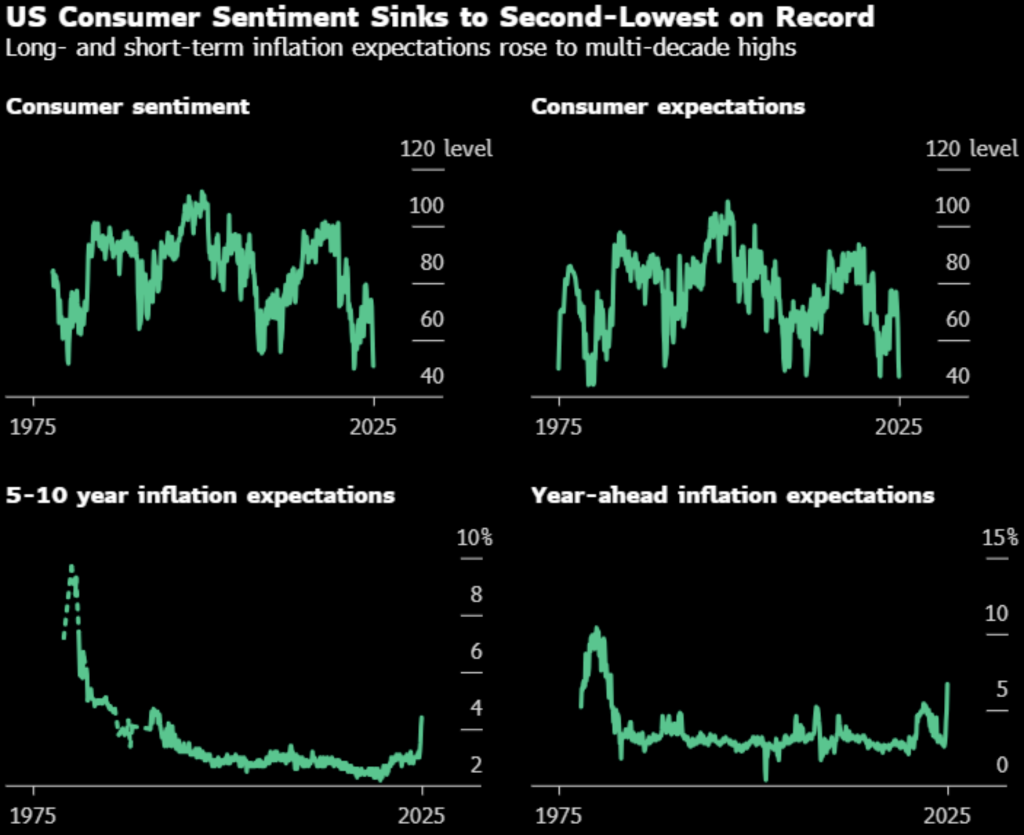

Source: Bloomberg. Underlying Data: University of Michigan

According to the latest University of Michigan survey, consumer sentiment has plummeted to the second-weakest level on record. Notably, this pessimism is bipartisan: Democrats, Independents, and Republicans alike are showing diminished outlooks, accompanied by inflation expectations hitting multi-decade highs amid rising tariff fears. The consumer has been a resilient force, helping prop up the economy through various headwinds. But consumer psychology can play a powerful role in economic cycles. When sentiment deteriorates to this extent, fear alone can trigger reduced spending—potentially tipping the economy into recession, regardless of what the hard data currently shows.

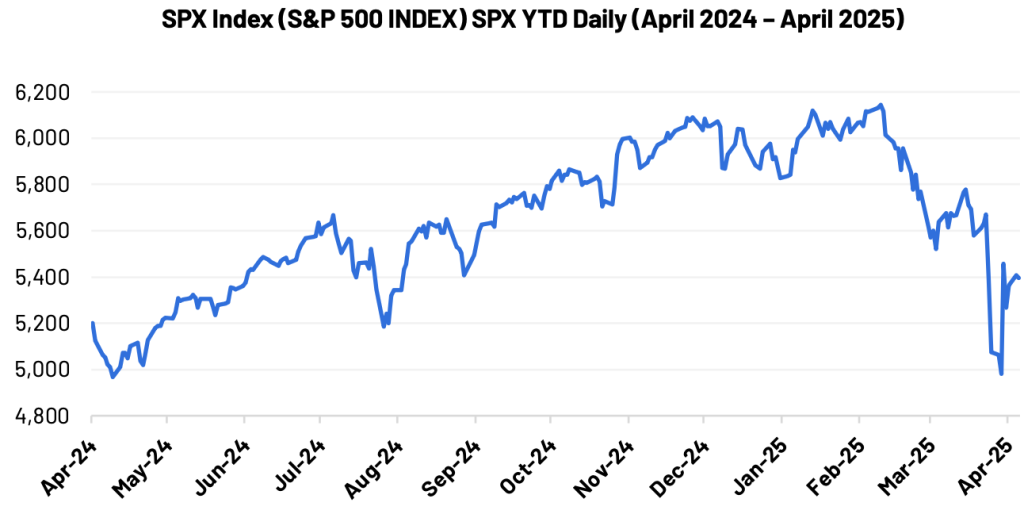

Markets Are Reflecting Uncertainty

Stocks have started to price in these growing uncertainties, and we expect volatility to continue as long as policy unpredictability persists. Markets, businesses, and investors alike need visibility into the road ahead before valuations can reflect any level of long-term confidence.

The Pitfalls of Market Timing

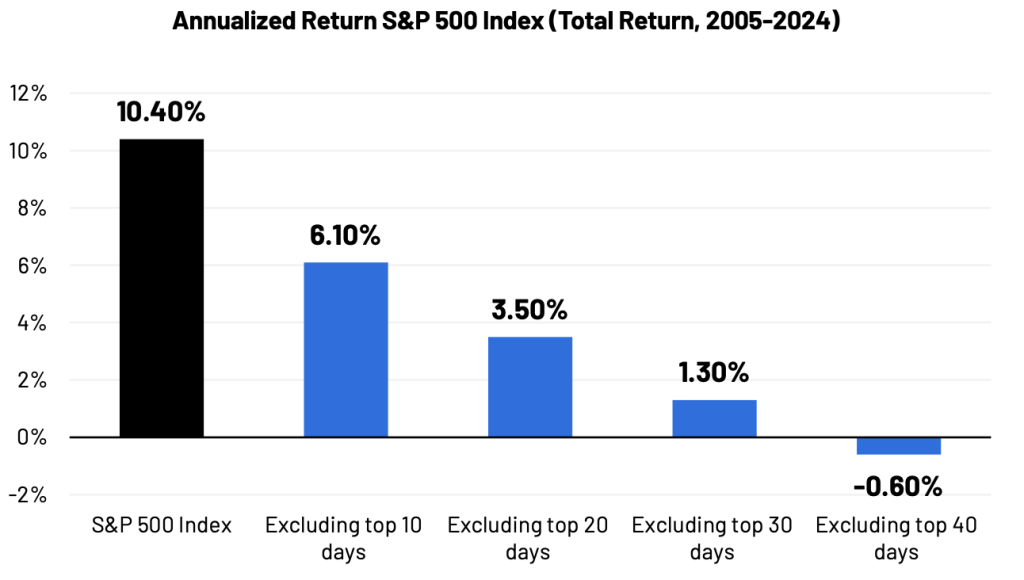

Trying to time the market in turbulent periods rarely works. Recoveries often begin before the broader economic indicators improve, making it nearly impossible to re-enter the market at the right moment. Historical data clearly shows that missing even a handful of the market’s best days can significantly impair long-term performance.

Source: Charles Schwab Quarterly Chartbook 04 2024 as of 12/31/24. Underlying data: Bloomberg

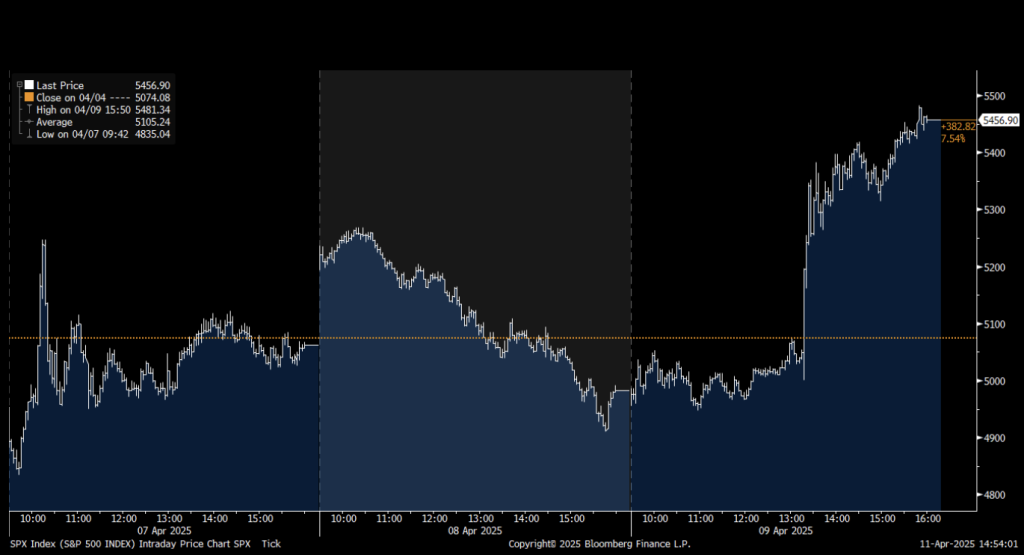

Recent price swings—driven by algorithmic trading reacting instantly to headlines or even social media posts—have caused entire indexes to gap up or down 5–10% within a single session. These moves are a stark reminder of how quickly wealth can be eroded when trying to outmaneuver volatility. The intraday chart of the S&P 500 over three days last week demonstrates this best:

Source: Bloomberg

Mr. Market and the Power of Discipline

In times like these, it’s helpful to revisit Benjamin Graham’s timeless parable of Mr. Market from The Intelligent Investor. In it, Graham describes a moody business partner who shows up daily with a price he’s willing to buy or sell your shares at—sometimes rational, sometimes erratic. The key takeaway is this: You don’t have to act on Mr. Market’s whims. Instead, you assess the true value of your investments based on fundamentals and act only when it suits your long-term strategy.

Mr. Market, in his manic-depressive state, was wildly optimistic heading into 2025 as many stock valuations became unmoored from reality. Now, he has turned pessimistic, punishing the high-valuation stocks he once exalted. This is precisely why one of our core investment principles is Valuation Matters.

Maintaining discipline around valuation is essential—not just for achieving strong long-term returns but also for protecting capital during downturns. Market volatility can be unsettling; however, these moments often present rare opportunities to buy high-quality businesses at deeply discounted prices—thanks to our emotional and erratic friend, Mr. Market.

As always, we thank you for your continued trust and partnership. We remain focused on fundamentals, guided by a long-term perspective, and vigilant in seeking value amidst volatility.

Manhattan West Asset Management, LLC (“MWAM”) is an SEC registered investment adviser located in California. MWAM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. This summary should not be construed by any consumer and/or prospective client as MWAM’s rendering of personalized investment advice. Any subsequent, direct communication by MWAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of MWAM, please contact the United States Securities and Exchange Commission on their web site at www.adviserinfo.sec.gov. A copy of MWAM’s current written disclosure brochure discussing MWAM’s business operations, services, and fees is available upon written request.