Founders and early investors in C-Corp businesses that issue QSBS have access to one of the most powerful tax incentives in the U.S. tax code.

The unique opportunity allows those who meet specific criteria under Section 1202 to legally reduce or exclude their federal capital gains tax obligations. This directly rewards those who took early risks to build innovative, high-growth businesses.

Background on QSBS (Section 1202)

Qualified Small Business Stock (QSBS) offers a substantial tax incentive for business founders, early employees, and investors, contingent upon satisfying the specific criteria set forth under Section 1202 of the U.S. Internal Revenue Code. If the stock qualifies, the holder can potentially allow up to 100% exclusion of capital gains when the stock is sold, depending on the amount of gain.

Requirements for QSBS:

- The issuer must be a C Corporation.

- The domestic company must have no more than $50 million in gross assets before and immediately after the stock issuance.

- The business must be active.

- At least 80% of the company’s assets must be active trades or businesses. Investments and real estate holdings do not qualify.

- Shares must be held for at least 5 years.

- The maximum gain exclusion is $10 million or 10X your adjusted basis in the stock.

- Anything above the threshold is taxable and eligible for capital gains rates.

Key Exclusions:

- LLCs, S-Corps, and partnerships do not qualify.

- If over 20% of the business is related to certain service-based or asset-holding activities, it does not qualify.

- Examples of nonqualifying business types include: Health, law, engineering, performing arts, farming, financial, mining, hospitality, and real estate companies.

- You can not claim the exception if you didn’t receive the stock from the original issuance.

- Stocks acquired through secondary sales or from another shareholder on the secondary market do not qualify.

- C-Corps can not claim the exclusion for themselves. It must be a non-corporate taxpayer.

The Business Owner’s Situation

Business owners considering an exit should carefully assess their exposure to capital gains taxes and the strategies available to mitigate it. The following real-world example demonstrates how early planning and proper structuring can greatly influence future tax outcomes.

In 2012, Camila Ruiz, a former film editor, invested $150,000 from her personal savings to start LumenEdit, a SaaS video editing platform for independent creators and marketing teams. She immediately incorporated the business as a Delaware C-Corporation.

Her first employee was her younger sister, Clara, who joined to manage customer success. Within six months of incorporation, LumenEdit formally issued founder stock to both Camila and Clara in late 2012.

Over the next decade, LumenEdit grew steadily. By its 10th year, it had:

- 43 full-time employees,

- $32 million in annual recurring revenue,

- Customers in over 40 countries,

- Profit margin averaging 18% for the past 3 years,

- Valuation interest from both strategic buyers and private-equity funds,

Camila maintained roughly 82% ownership, having raised only a small amount from angel investors in her first year, to retain control.

In the company’s 11th year, Camila suffered a serious hiking accident that required months of recovery and an extended time away from the day-to-day of the business. During her recovery, she reflected on her future and decided to sell the company to secure financial freedom for her family and fund her philanthropic goals to give back to her local community.

She had a million questions: Her business is only 11 years old, can she take advantage of any tax benefits? She doesn’t own 100% of the stock; does that affect her tax liability? What can she do before the sale to maximize her tax savings? Would a multi-million dollar charitable contribution be more effective before or after the sale?

She needed to understand her options to decide on her next steps. Before making any final decisions, she consulted with her personal wealth manager and estate planning attorney, whom she had worked with for the past five years.

After receiving several offers, Camila accepted one from VistaWave Technologies, a large creative-software conglomerate, for a stock sale valued at $185 million.

However, before signing on the dotted line, she needed to ensure that she qualified for the QSBS tax exception.

Applying the QSBS Strategy

Camila and her team confirmed that her SAAS video editing company qualified under Section 1202 and met the following requirements:

- The shares were held for 11 years, meeting the 5-year holding minimum.

- Stock was issued directly to her and her sister by the C-Corp.

- The upcoming sale was structured as a stock sale and not an asset sale.

- Stock was issued within the first 6 months of forming the C-Corp, and the company had less than $500k in assets. That was well below the $50M threshold needed for QSBS eligibility.

By understanding the qualifications, the company’s founder could confidently structure her exit and clarify her tax obligations.

Tax Results from the Case Study

When Camila Ruiz initially incorporated her business, she did not fully appreciate the magnitude of the potential tax benefits she had unknowingly established. That early decision, however, would later prove pivotal as the company’s value grew exponentially.

Camila’s cost basis in her shares was minimal, roughly $150,000. Her capital gain was about $151 million ($151M = 82% × $185M − $150K).

Under QSBS, she could exclude up to the greater of $10 million or 10X her original investment from federal capital-gains tax. Because her investment was $150K, the exclusion cap was $10 million for her personally.

To optimize the transaction and ensure an efficient exit, Camila coordinated with her finance team and estate planning attorney to implement a pre-sale gifting strategy.

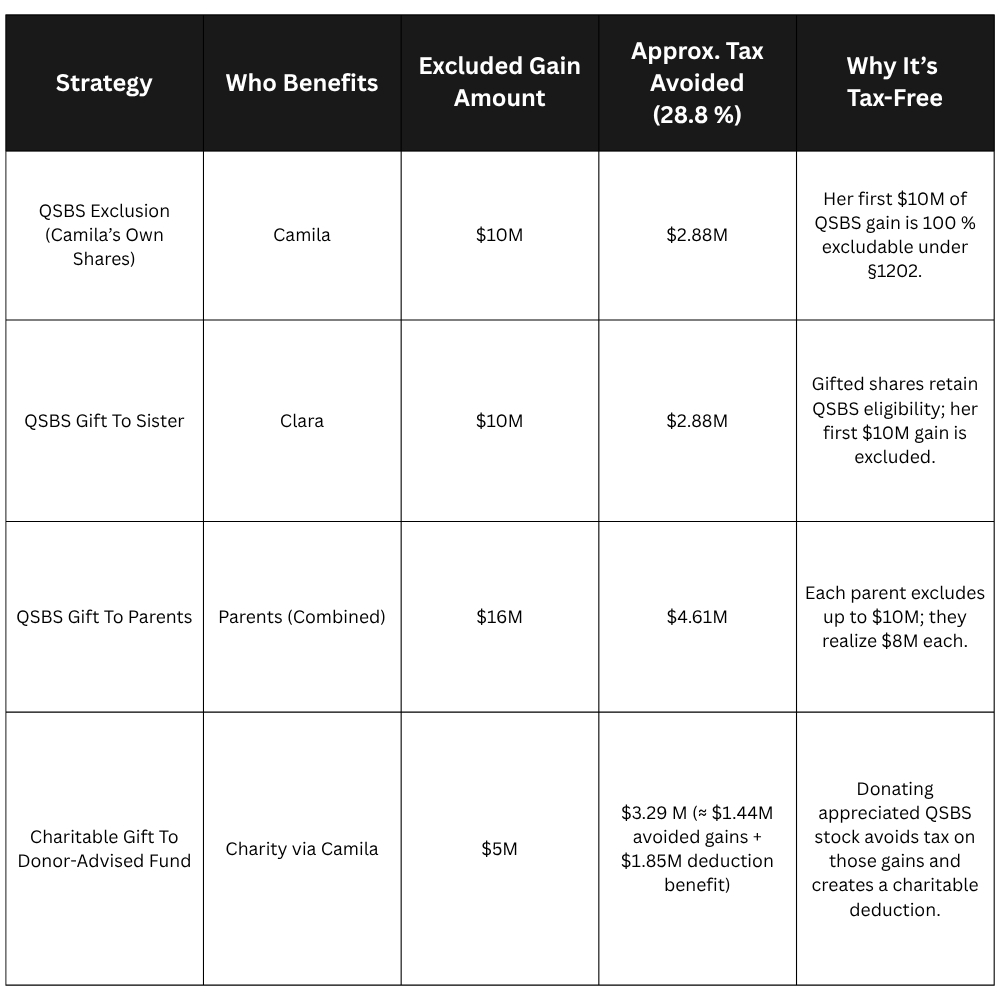

Three months prior to the sale, she made the following QSBS-Eligible transfers and gifted:

- To her sister Clara: $10 million in stock.

- To her parents: $8 million in stock, split evenly between them.

- To a Donor-Advised Fund (DAF): $5 million to fulfill her philanthropic goal of supporting local creative-arts and education charities in her hometown.

Assuming a combined capital gains tax rate of 28.8% (federal + NIIT + state), the total tax exposure without QSBS or gifting would have been approximately $43.7M on $151.7M in gains.

However, through the successful application of QSBS exclusions and the pre-sale gifting strategy, a significant portion of the gain was rendered federally tax-free. This resulted in millions in tax savings for Camila and her family.

That meant the Ruiz family and their charitable foundation together kept about $13.66M more than they would have without the QSBS and gifting plan, roughly a 30% reduction in the overall tax bill on the stock sale.

Risks and Limitations

QSBS exclusions offer a powerful tax advantage, but they also entail significant risks and limitations. To qualify, the business must be structured as a C-Corporation. Many business owners struggle to meet the first requirement, as many of them operate as LLCs or S-Corps, which are ineligible. Businesses in service-based industries, such as hospitality or law, generally do not qualify.

It is critical for business owners to maintain meticulous record-keeping from the time of the stock issuance to the full holding period to verify compliance.

While Section 1202 deals with federal-level tax exceptions, state tax rules significantly depend on which state your C-Corp was registered in. Some states conform to federal QSBS rules, like Colorado and Delaware, while others do not offer any QSBS exclusions, like California.

It’s imperative for founders and investors to plan with trusted tax advisors to ensure full compliance and to optimize their after-tax outcomes.

Lessons from the Case Study

By choosing C-Corps rather than S-Corps, founders and early investors can access QSBS benefits, one of the most significant tax advantages available. With thoughtful planning from the time of formation, founders, like Camila Ruiz, can position themselves for multi-million dollar tax savings at their exit.

Conclusion

As illustrated in the case study, it’s imperative to understand and plan for QSBS eligibility from the time of formation. Selecting a C-Corp structure, maintaining meticulous records, and holding shares for the required period can translate into millions of dollars in potential tax savings at the time of an exit.

Founders who incorporate QSBS planning into their overall business strategy can unlock benefits that extend well beyond the immediate tax relief. Proper structuring and planning can lay the foundation for a long-term wealth management strategy, enabling founders to create lasting value for themselves, their families, and future endeavors.

Business owners should consult experienced tax, legal, and financial advisors to structure ownership and entity formation to maximize QSBS eligibility and support long-term financial goals.