In our Q3 2024 State of the Market Update, we urged investors to take a deep breath and zoom out—to anchor decision-making to long-term goals rather than react to an onslaught of market-moving headlines. To say that this simple advice has grown more important over the past year would be an understatement.

Consider this sampling of headlines:

“Trump says U.S. will run Venezuela after U.S. captures Maduro” – Reuters

“Trump Declares Anything Less Than U.S. Control of Greenland Is ‘Unacceptable’” – Time

“Market risk mounts as Supreme Court weighs Trump’s emergency tariff powers” – Reuters

“On the verge of strikes in Iran, the US held off. What happens next is up to Trump” – CNN

“Minnesota and the Twin Cities sue the federal government to stop the immigration crackdown” – Associated Press

“DOJ launches criminal investigation into Fed Chair Jerome Powell” – ABC News

“Why Banks Are So Worried About a 10% Credit Card Rate Cap” – The New York Times

“Trump signals plan to ban institutional investors from buying single-family homes” – Kiplinger

“Trump’s order for Freddie, Fannie to buy $200 billion mortgage bonds raises IPO doubts” – Reuters

“Trump Administration Takes Aim at Home-Builder Stock Buybacks” – The Wall Street Journal

“Trump says he will not permit dividends and stock buybacks for defense companies” – CNBC

“Trump calls for US military spending to rise more than 50% to $1.5tn” – BBC

You would be forgiven for assuming these were excerpts from a “2025 Year in Review.” They are not. Every one of these headlines was published in the first two weeks of 2026 alone. Unsurprisingly, this torrent of news has driven sharp, often violent, moves across equities, commodities, currencies, and interest rates—frequently in both directions within days, or even hours.

So what is our team at Manhattan West doing to navigate this firehose of information?

In many cases, we are doing very little. Deliberately.

A natural question follows: How can an active manager afford not to trade on headlines like these?

The short answer is simple—reacting reflexively to headline risk is one of the most reliable ways to destroy long-term capital.

Modern markets are dominated by algorithmic and event-driven strategies, many of which are explicitly designed to scan platforms like Truth Social and X (formerly Twitter) and trade instantly on new proclamations. The problem is not speed; it is signal quality. Initial market reactions are frequently reversed by follow-up statements, clarifications, or outright contradictions—sometimes within the same trading session.

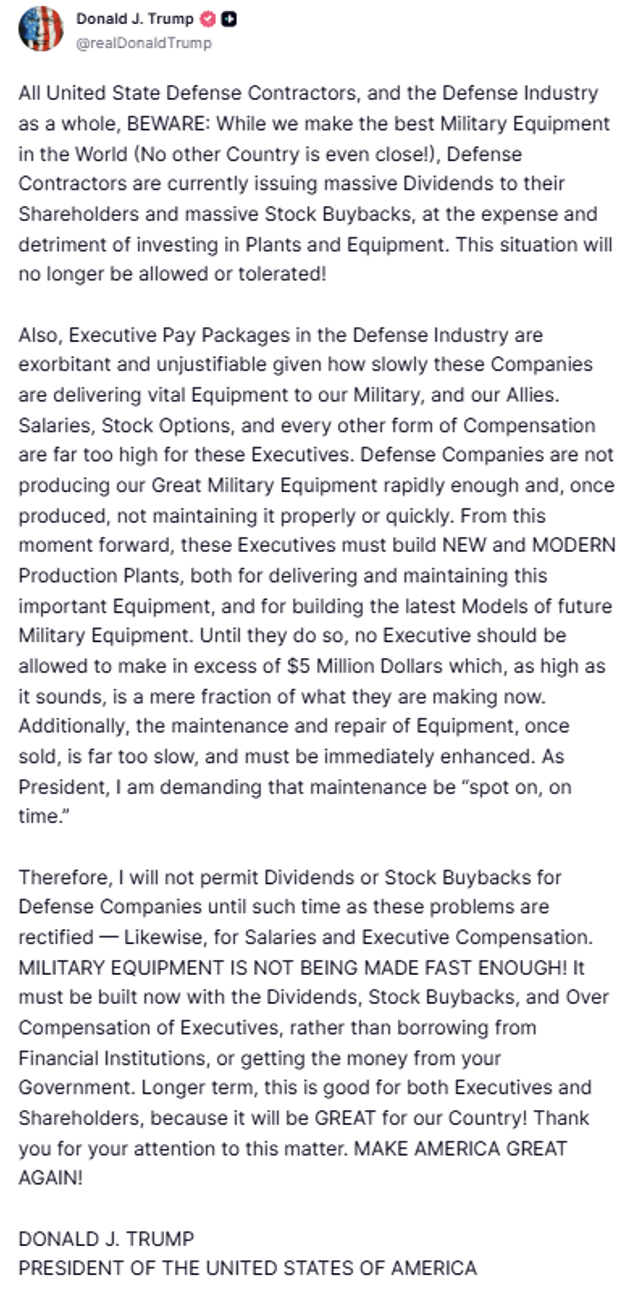

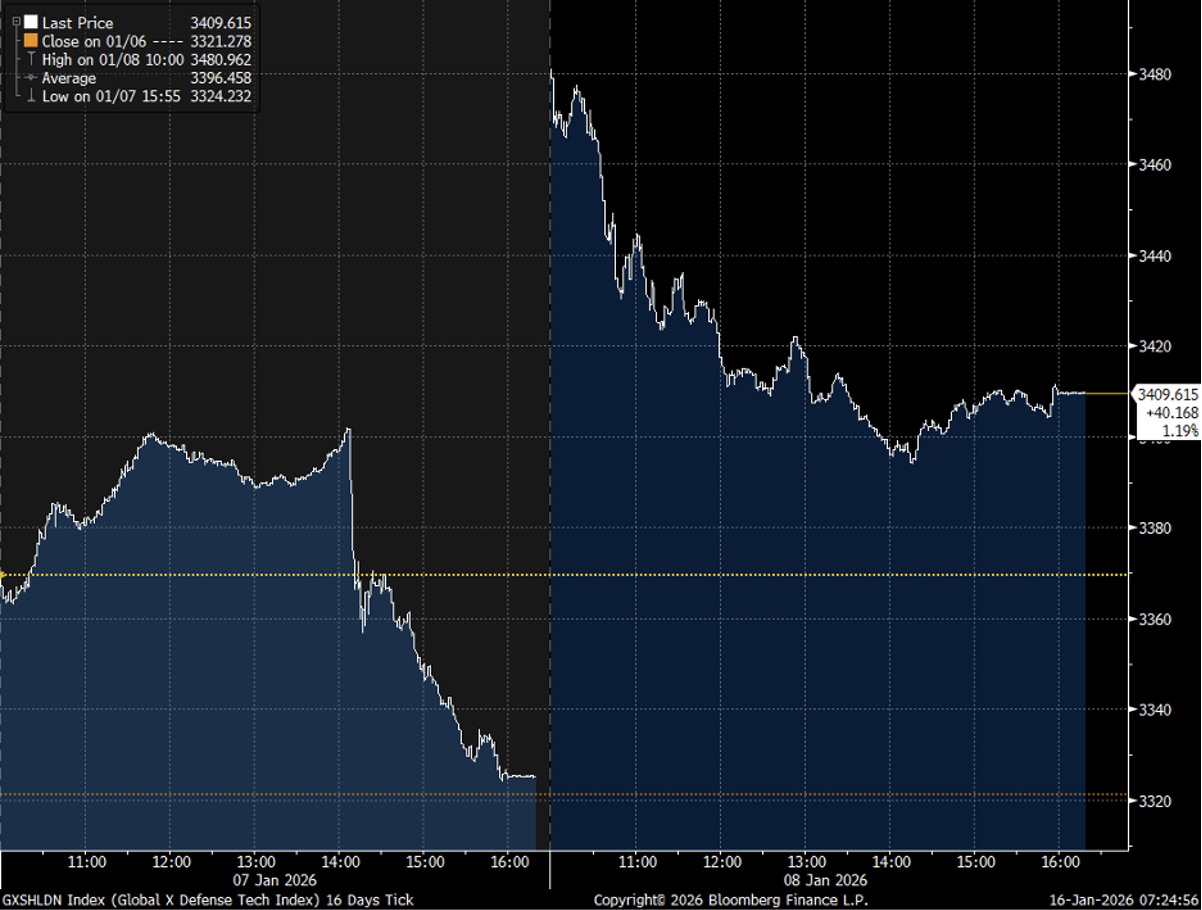

We saw a textbook example of this dynamic on January 7th. Following a 2:08 p.m. (EDT) Truth Social post, stocks in the Global X Defense Tech Index declined 2.3%.

Source: Truth Social

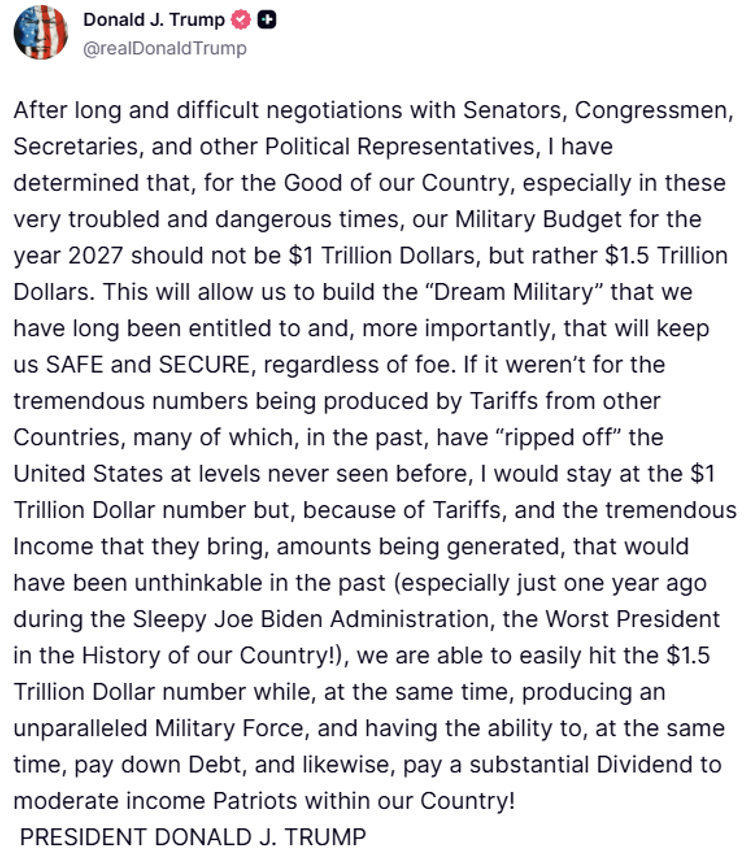

Just over two hours later, a second post—issued at 4:17 p.m. (EDT), shortly after the market close—reversed the narrative.

Source: Truth Social

An investor who sold in response to the first post and repurchased following the second suffered a loss of more than 5% in less than 24 hours. Repeat this behavior often enough and the compounding engine that drives long-term wealth creation is steadily eroded.

Source: Bloomberg

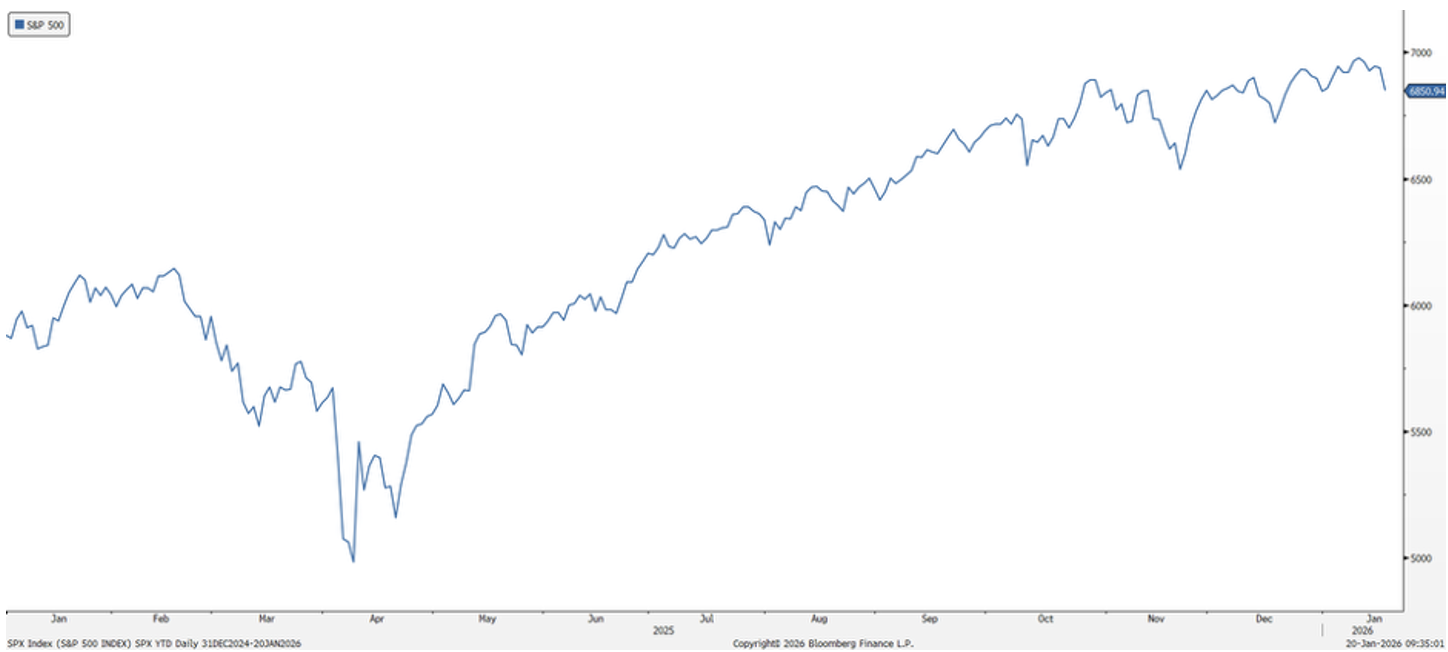

Recent history reinforces this lesson. Investors who abandoned their long-term plans during the “Liberation Day” market drawdown in April 2025—driven largely by tariff fears—permanently impaired their compounding potential. The S&P 500 went on to gain approximately 38% over the remainder of the year, returns that were missed by those who chose reaction over discipline.

Source: Bloomberg

To be clear, we are not suggesting that policy outcomes are irrelevant. They are not. Policies that are ultimately implemented can and do have meaningful consequences for economies, industries, and individual businesses.

For example, proposed changes to the 2026 tax code—including increases to the standard deduction, a higher SALT cap, elimination of taxes on tips, deductibility of car loan interest, and full expensing of corporate research and development costs—could provide a meaningful tailwind to economic activity and corporate profitability. At the same time, ongoing tariff uncertainty acts as a tax on consumers and complicates corporate planning, forcing management teams to make long-term capital allocation decisions amid constantly shifting rules.

This tension—between fiscal stimulus and policy uncertainty—is precisely why short-term trading is such a poor response. The outcomes are unknowable in the moment, and markets are already heavily discounting each new headline in real time.

So what can we do as active managers in this environment?

The answer lies not in short-term trades, but rather a long-term philosophy. We focus on owning high-quality businesses with strong balance sheets, ample liquidity, durable competitive advantages, and management teams capable of adapting to a changing economic and regulatory landscape. Financial flexibility matters. Business model resilience matters. Valuation discipline matters.

In an era where markets are increasingly driven by noise, patience and selectivity remain among the few durable edges available to long-term investors.

As always, we appreciate your continued trust and partnership.

Manhattan West Asset Management, LLC (“MWAM”) is an SEC registered investment adviser located in California. MWAM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. This summary should not be construed by any consumer and/or prospective client as MWAM’s rendering of personalized investment advice. Any subsequent, direct communication by MWAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of MWAM, please contact the United States Securities and Exchange Commission on their web site at www.adviserinfo.sec.gov. A copy of MWAM’s current written disclosure brochure discussing MWAM’s business operations, services, and fees is available upon written request.