“History never repeats itself, but the kaleidoscopic combinations of the pictured present often seem to be constructed out of the broken fragments of antique legends.”

— Mark Twain & Charles Dudley Warner, The Gilded Age: A Tale of Today (1873)

This passage—likely the source of Twain’s famous quote—feels especially relevant today.

As the bull market moves past its three-year mark, the market’s exuberance for all things artificial intelligence continues to build. The enthusiasm is palpable: AI has become the defining investment theme of this cycle, influencing not only technology stocks but the broader market narrative.

In many ways, the current environment echoes the late 1990s, when the promise of the internet reshaped expectations for growth, productivity, and valuation. Yet while there are clear parallels to the dot-com era, there are also important differences that warrant careful distinction. Now is an opportune time to ask how much history truly rhymes—and how that informs our investment approach going forward.

Echoes of the Past

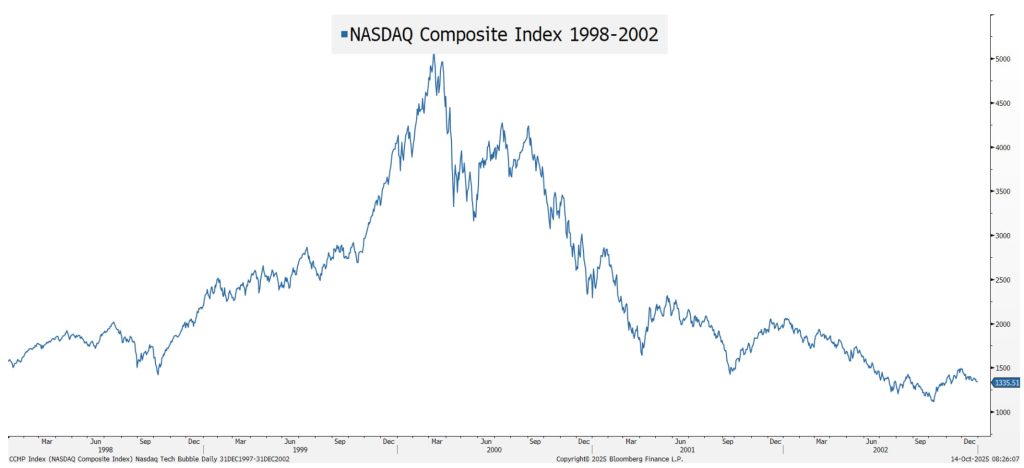

During the dot-com bubble, investors extrapolated early signs of internet adoption into boundless growth expectations. Valuations detached from fundamentals as capital flooded into companies with little revenue and even less profitability. When the bubble burst, the NASDAQ ultimately fell nearly 80% from its March 2000 peak.

Source : Bloomberg

Today’s AI narrative shares several similarities. The speed of innovation, the scale of investment, and the language of “paradigm shift” all mirror the optimism of 25 years ago. Capital expenditures by cloud providers and semiconductor firms have surged to record levels. Market concentration has reached extremes—AI-linked mega caps now represent over 35% of the S&P 500’s market capitalization. And once again, the belief that “this time is different” is driving increasingly riskier bets across the AI ecosystem.

This Time Is Different

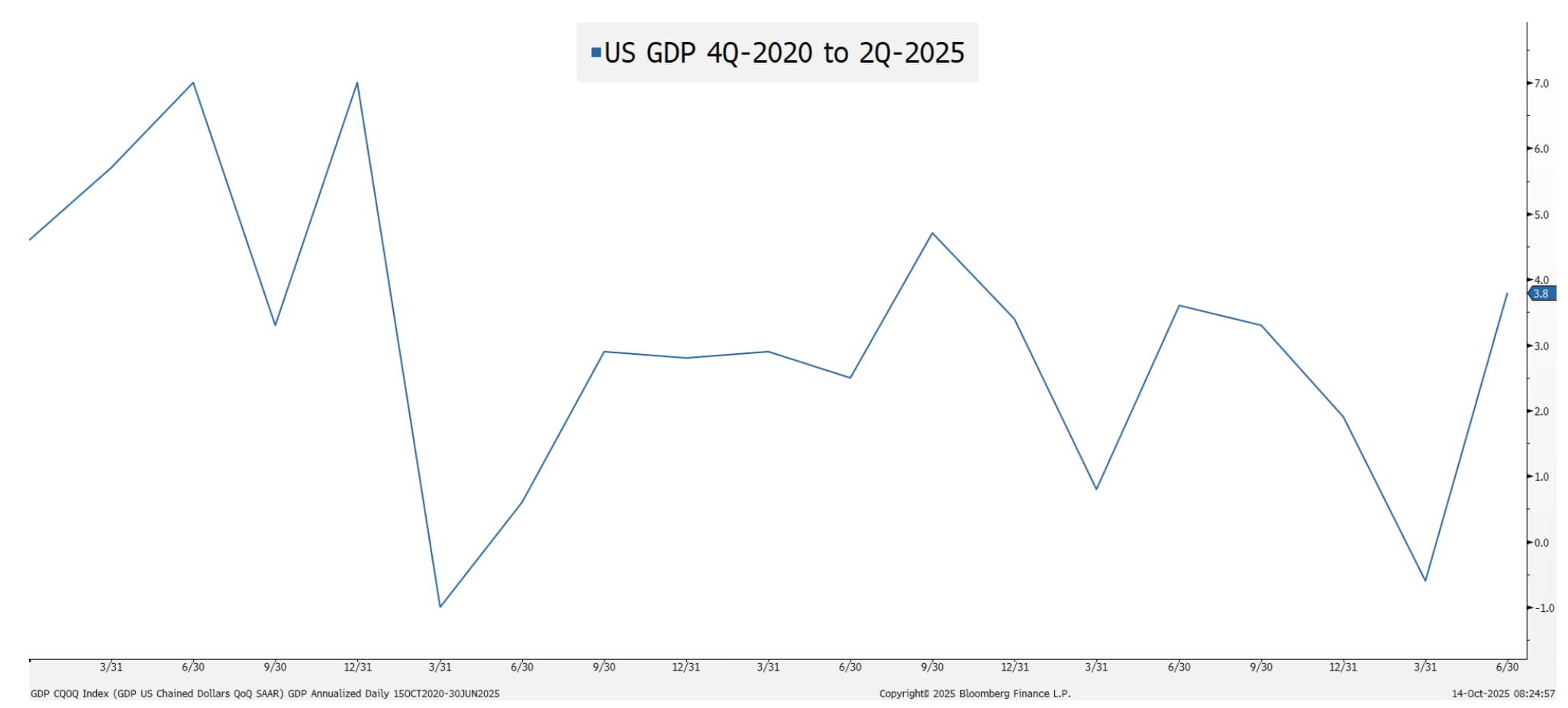

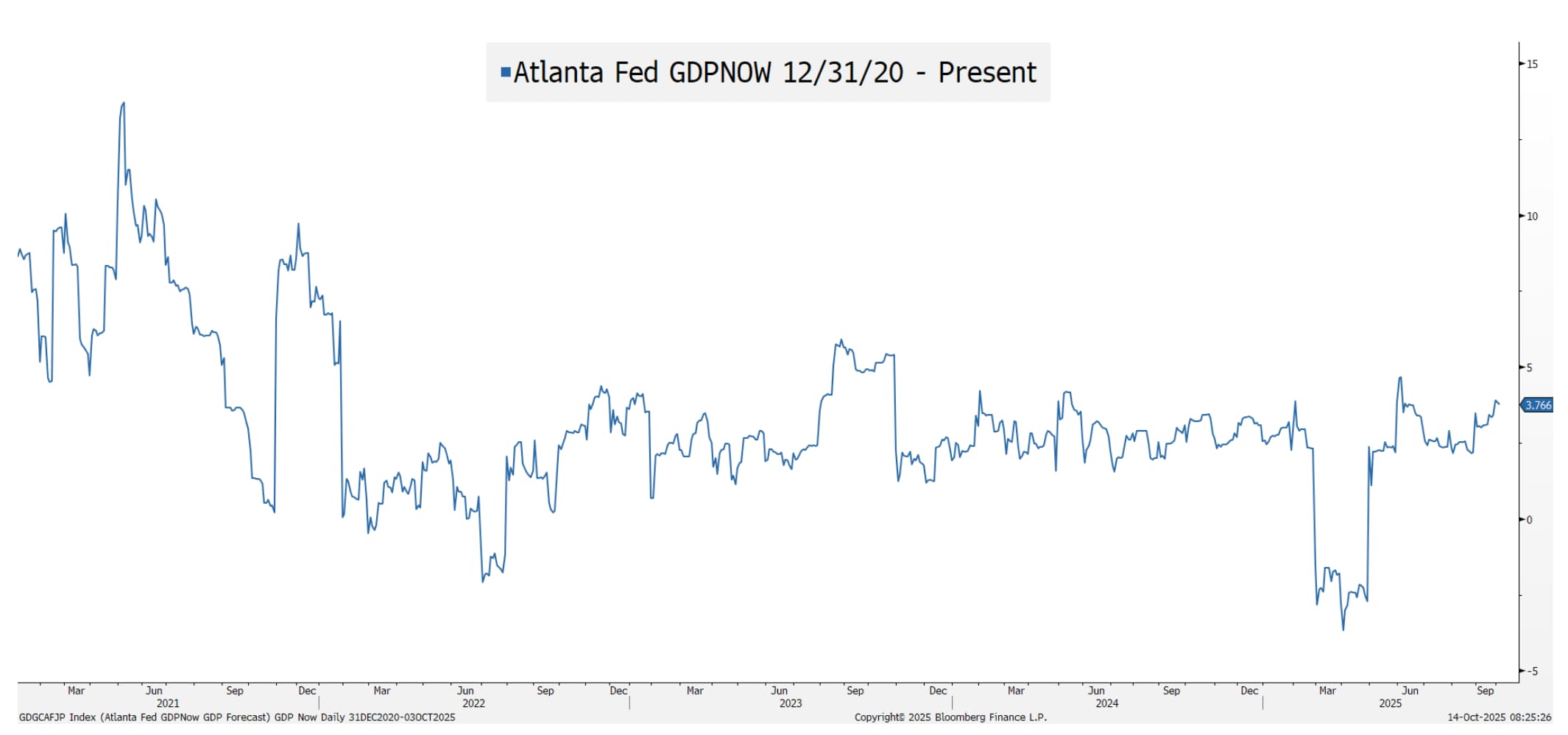

Unlike the dot-com era, today’s technology leaders are deeply profitable, entrenched, and integral to the global economy. The mega cap technology companies of today generate enormous free cash flow and hold dominant positions in essential technologies. So far, expanding valuation multiples have been supported by robust earnings growth. Moreover, evidence of AI-driven productivity gains has begun to bolster U.S. GDP, offsetting some of the drag from a still-sluggish labor market.

Source: Bloomberg Source: Underlying Data: Bureau of Economic Analysis

Source: Bloomberg. Underlying Data: Federal Reserve Bank of Atlanta

Yet exuberance breeds fragility. Just as in the dot-com era, we expect significant amounts of capital to be misallocated—and, ultimately, incinerated. Having more capital to deploy does not guarantee an adequate return on that capital.

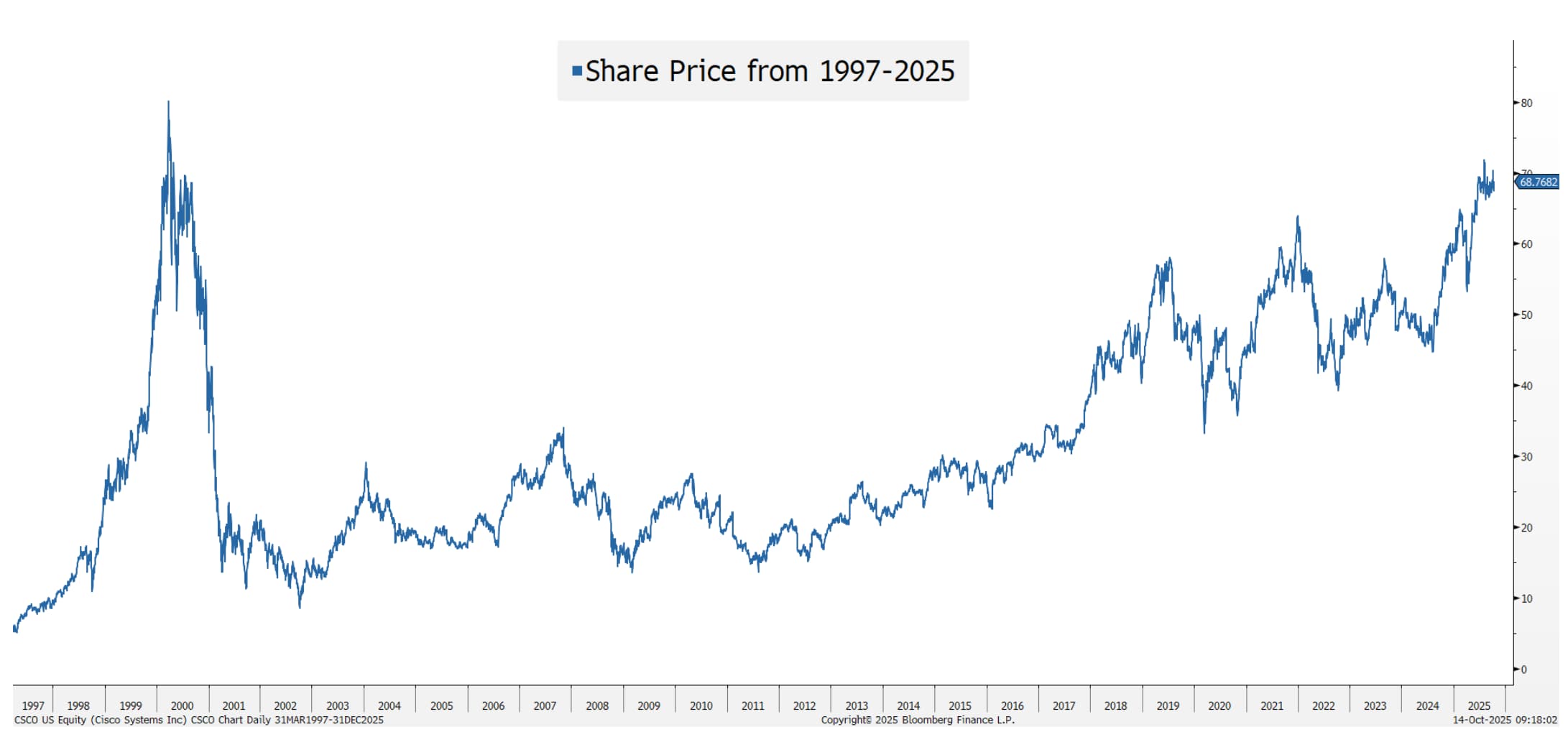

Dot-Com Revisited

In the late 1990s, investment poured into fiber optics, network equipment, and web infrastructure—much of it based on wildly optimistic projections for internet traffic and demand. Many companies of that era failed; those that survived often took years to recover. One well known networking technology company is a telling case study. As the physical backbone of the internet, this company’s routers and switches fueled explosive growth—and its stock reflected that optimism. The company even financed many of its customers’ purchases, creating a circular economy that proved unstable when the bubble burst and many of their customers failed. This company’s shares ultimately fell 80% and, remarkably, have yet to revisit their 2000 highs.

Source: Bloomberg

We may be witnessing a similar dynamic today. Semiconductor capacity, AI training clusters, and data center buildouts are expanding at a dizzying pace. History suggests such capital intensity often leads to periods of oversupply and margin compression before equilibrium is restored.

Investors should distinguish between the technology trend—which may well be transformative—and the investment opportunity, which may be less compelling at current valuations.

Forecasts of limitless AI-driven productivity rely on assumptions about monetization, regulation, and scalability that remain untested. The market appears to be pricing in a smooth, linear path to mass adoption—leaving little room for the inevitable setbacks, cost overruns, and competitive pressures that accompany every technological revolution.

Compounding the risk is an emerging “circular economy” dynamic, in which hardware providers are increasingly financing their customers’ infrastructure buildouts. Recent headlines highlight a growing trend: semiconductor manufacturers and cloud service providers investing in large language model developers, who then use those funds to construct data centers by purchasing semiconductors and cloud capacity from the same investors. The broader adoption of this financing structure adds leverage to the system and heightens the potential for systemic fragility across the ecosystem.

The Path Forward

As stewards of your capital, our goal remains unchanged: to capture long-term value creation while avoiding the excesses that so often precede painful corrections. We continue to participate selectively in structural growth themes, but with a disciplined focus on valuation, cash flow, and balance sheet strength. We hold high-quality technology firms with durable competitive advantages, yet remain cautious about extrapolating recent earnings momentum too far into the future.

The AI revolution is real—but so are the risks of collective overconfidence. The internet did change the world, but investors in 1999 paid too high a price for that truth. Two decades later, we benefit from hindsight: technological transformation and disciplined investing are not mutually exclusive.

As always, we appreciate your continued trust and partnership.

Manhattan West Asset Management, LLC (“MWAM”) is an SEC registered investment adviser located in California. MWAM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. This summary should not be construed by any consumer and/or prospective client as MWAM’s rendering of personalized investment advice. Any subsequent, direct communication by MWAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of MWAM, please contact the United States Securities and Exchange Commission on their web site at www.adviserinfo.sec.gov. A copy of MWAM’s current written disclosure brochure discussing MWAM’s business operations, services, and fees is available upon written request.