As the Tour de France concludes, we find apt parallels between the world’s most grueling cycling race and today’s capital markets. Just as riders and teams in the Tour adopt different strategies based on their strengths and goals, investors are navigating a similarly complex environment with divergent approaches.

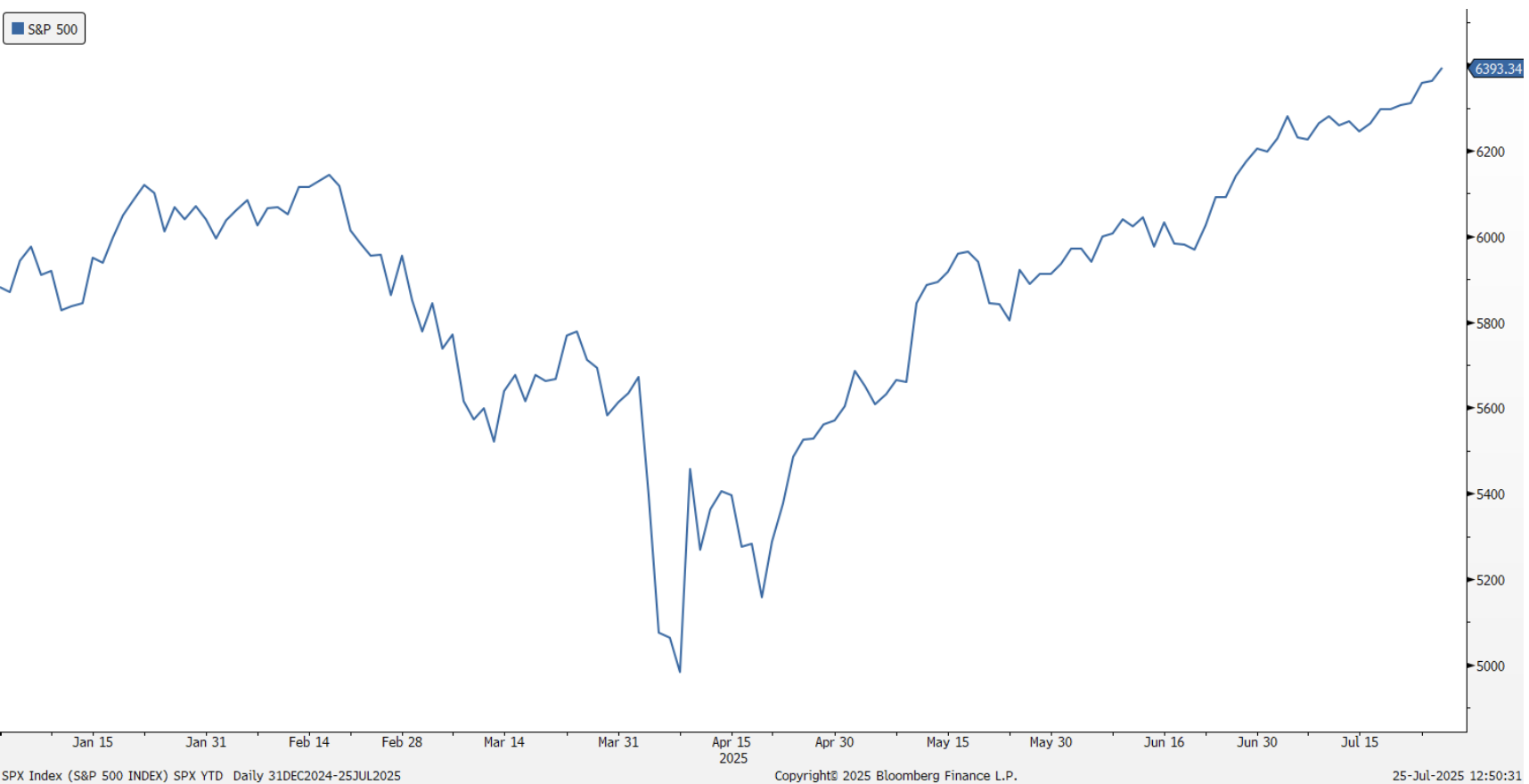

In cycling, sprinters focus on stage wins—flat, fast bursts where power triumphs. The post-tariff-announcement rally since “Liberation Day” in April certainly resembled one of those sprint stages. The S&P 500 has surged more than 25% from its lows, driven by a resurgence in speculative behavior: SPACs are reappearing, meme stocks have returned, and some unprofitable companies are pivoting to cryptocurrency—issuing equity to fund purchases of Bitcoin and Ethereum, with investors enthusiastically paying $2 for $1 worth of crypto. Wild, indeed.

Source: Bloomberg

But sprinters rarely win the yellow jersey. That’s reserved for general classification riders—those who stay disciplined, conserving energy during the early stages and attacking strategically in the mountains. Investing, when done properly, is a long race. It demands patience and discipline. Chasing fast money often leads to burnout, while success comes from seizing opportunities—especially during challenging stretches of the course.

Though markets are currently riding a strong tailwind, several significant headwinds remain:

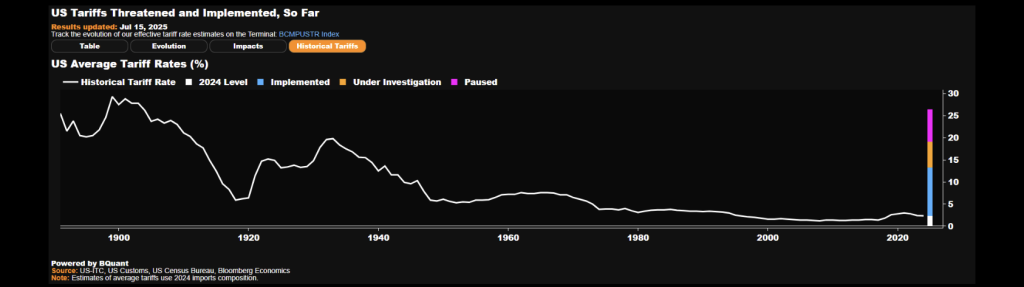

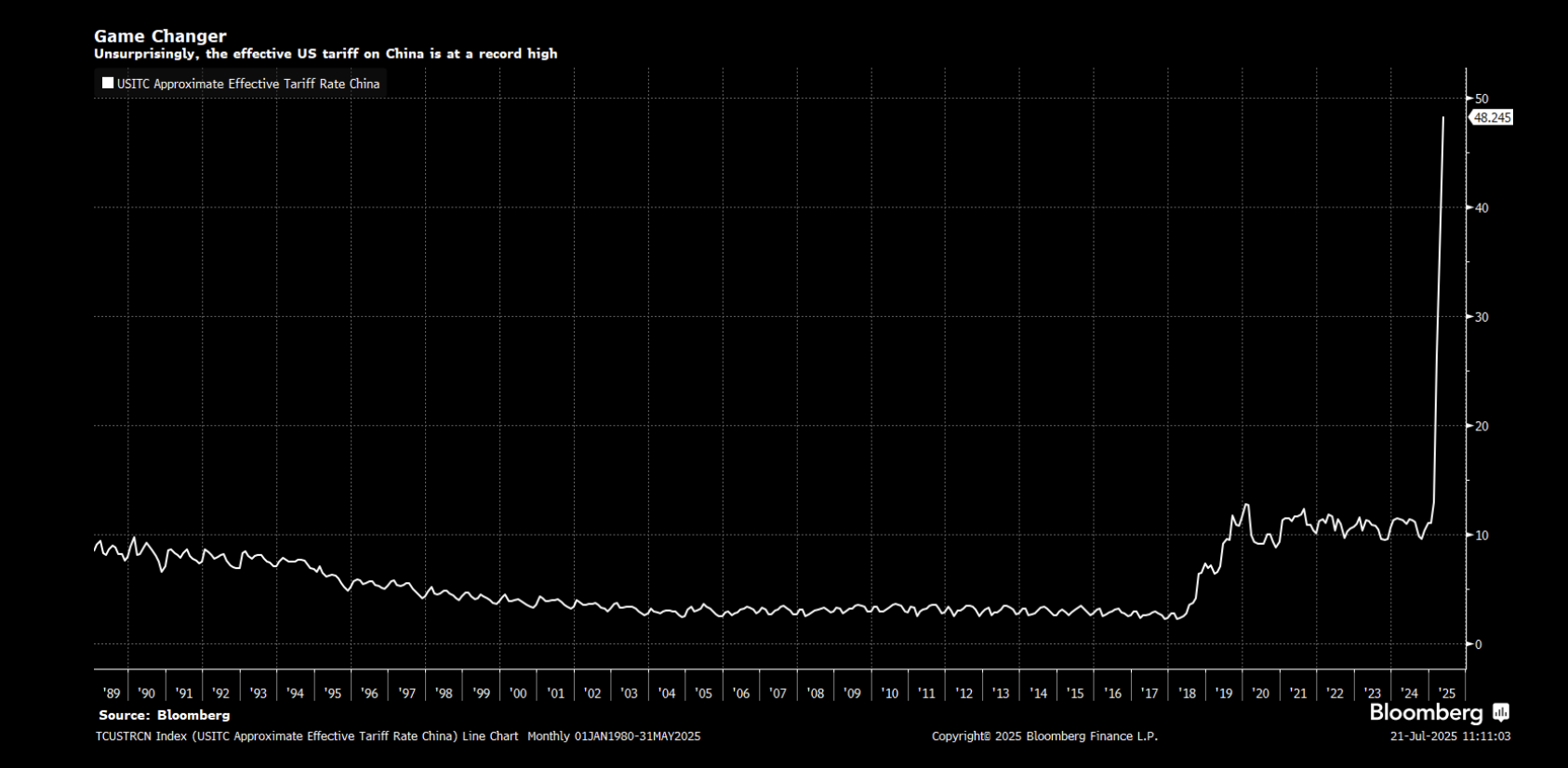

Tariffs Are a Tax

Despite the pause in tariffs announced on “Liberation Day” (April 2nd) as negotiations unfold, the baseline level of tariffs today remains higher than at any point in the last 80 years.

Source: Bloomberg. Underlying Data: US International Trade Commission, US Customs, US Census Bureau, Bloomberg Economics

Source: Bloomberg. Underlying Data: US International Trade Commission

These effects are beginning to show up in consumer prices—particularly for imported goods like toys, furniture, appliances, and apparel. Core goods prices (excluding autos) rose 0.55% in June, the largest monthly jump since November 2021.

While services inflation, especially shelter costs, has cooled recently, higher goods prices are likely diverting consumer spending away from services. In our view, tariffs are not broadly inflationary but are a drag on economic growth. They represent a shift in how and where consumers spend—ultimately weighing on the broader economy.

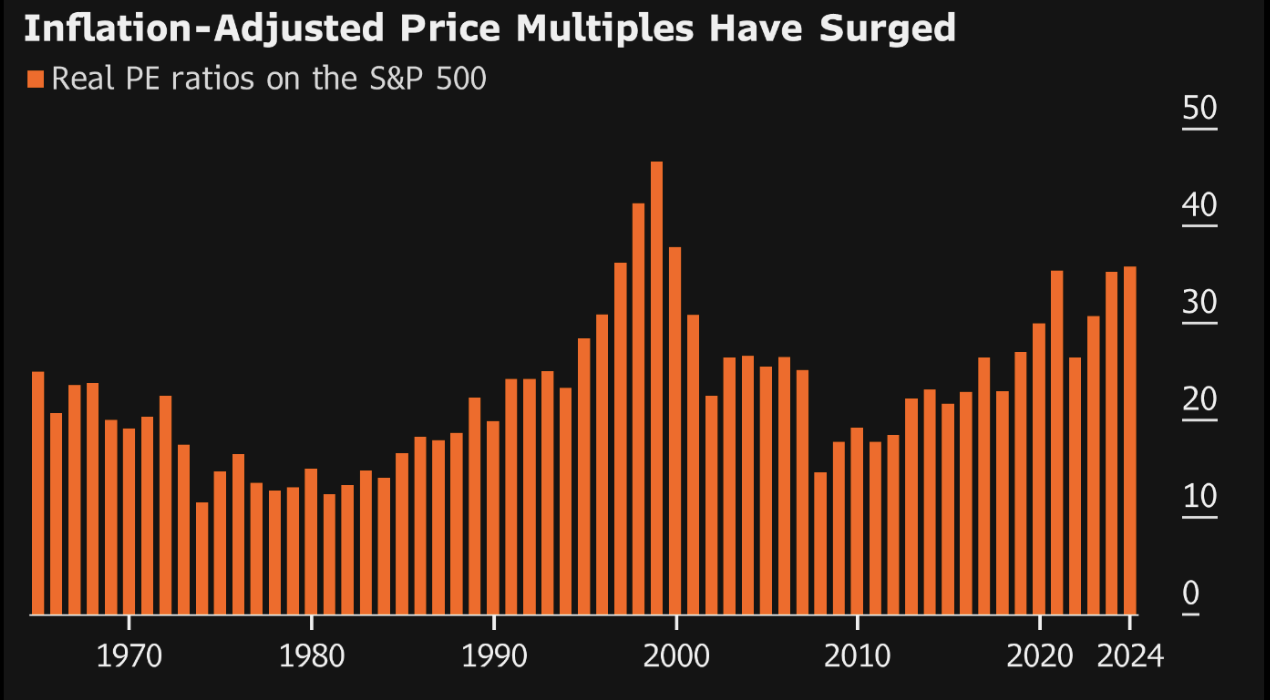

Valuations Are Stretched

As we’ve said before, valuation is a poor short-term market timing tool—stocks can remain expensive for quite a while. But for long-term investors, valuations are a crucial determinant of future returns. Today, the S&P 500’s cyclically adjusted price-to-earnings ratio is at levels not seen since the tech bubble of the early 2000s.

Source: Bloomberg

Much of the current enthusiasm is centered on artificial intelligence, a potentially transformative technology. To be fair, today’s market leaders are real businesses generating real cash flow—not just concepts ending in “.com.” Still, a growing number of companies are trading at valuations we view as unsustainable. We continue to adhere to our “growth at a reasonable price” philosophy, avoiding the froth and identifying quality businesses trading at discounts to intrinsic value.

The Growing U.S. Debt Load

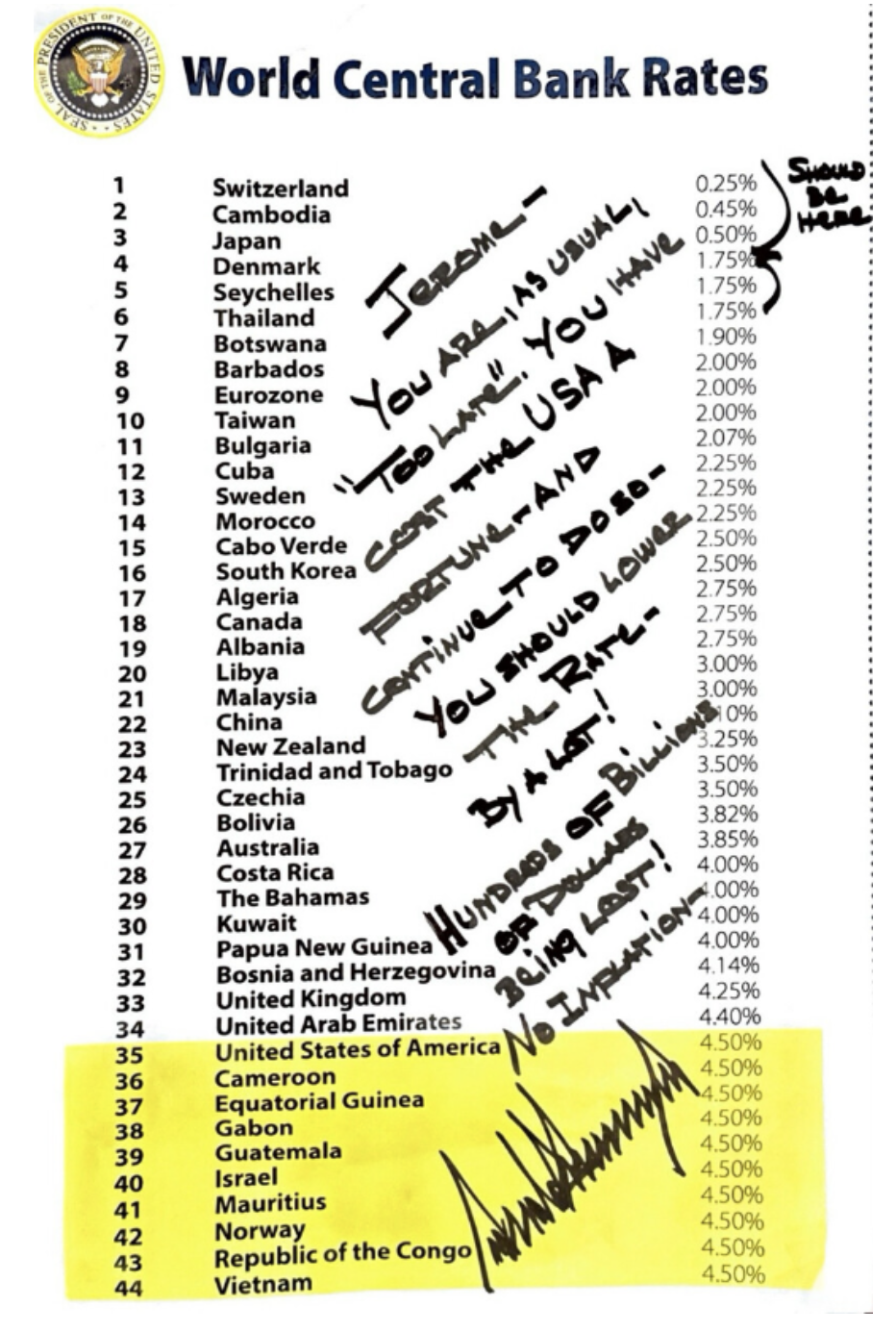

The administration has called on Fed Chair Jay Powell to lower interest rates, hoping to offset potential tariff fallout and reduce the government’s interest expense. (See the now-infamous handwritten note from Trump to Powell.)

Source: Truth Social

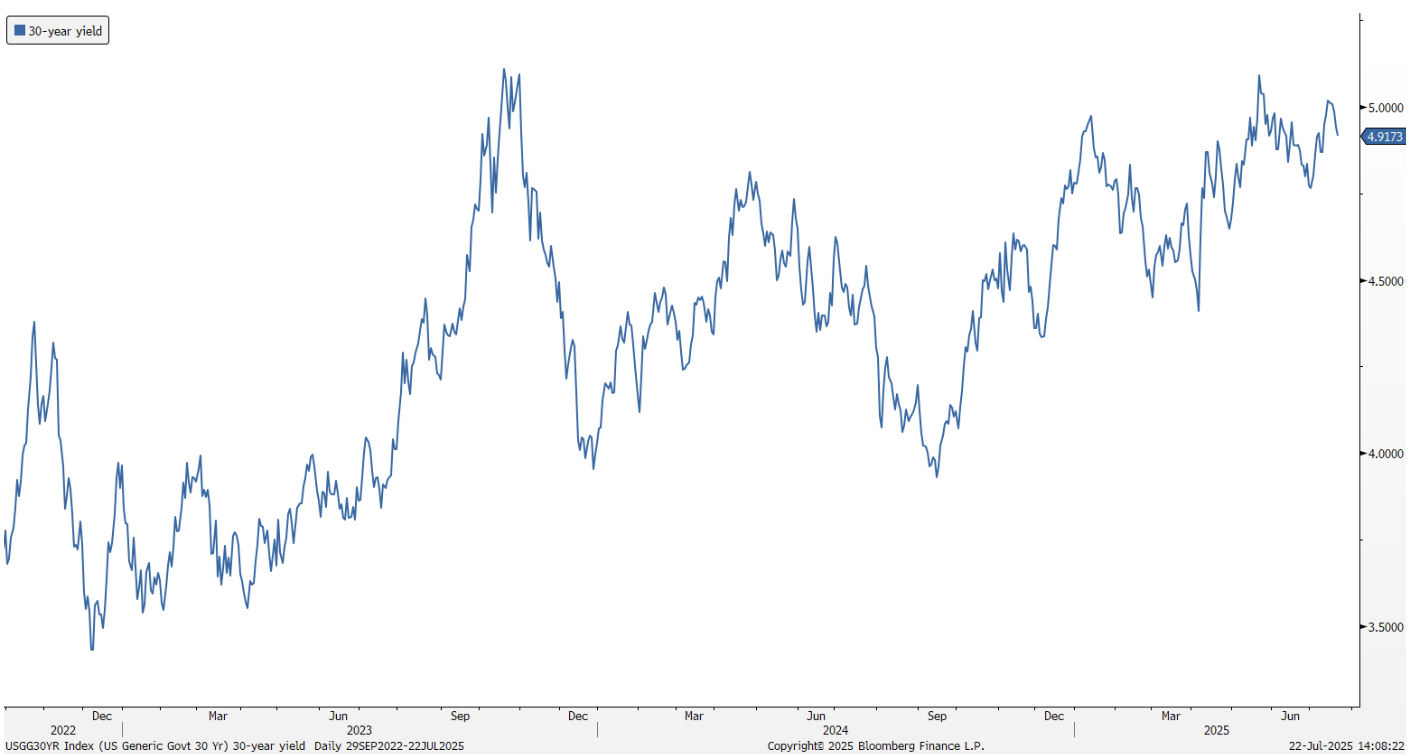

However, cutting rates without labor market weakness risks reigniting inflation. The Fed is likely to resist, especially given two major inflationary pressures: tariffs and the recently passed “Big Beautiful Bill,” which the Congressional Budget Office estimates will add $3.4 trillion to the national debt. Rather than bringing rates down, this additional fiscal stimulus has pushed long-term yields higher, as investor demand for U.S. debt and the dollar begins to soften.

Source: Bloomberg

We believe the administration may eventually get its rate cuts—but likely only in response to a slowing economy.

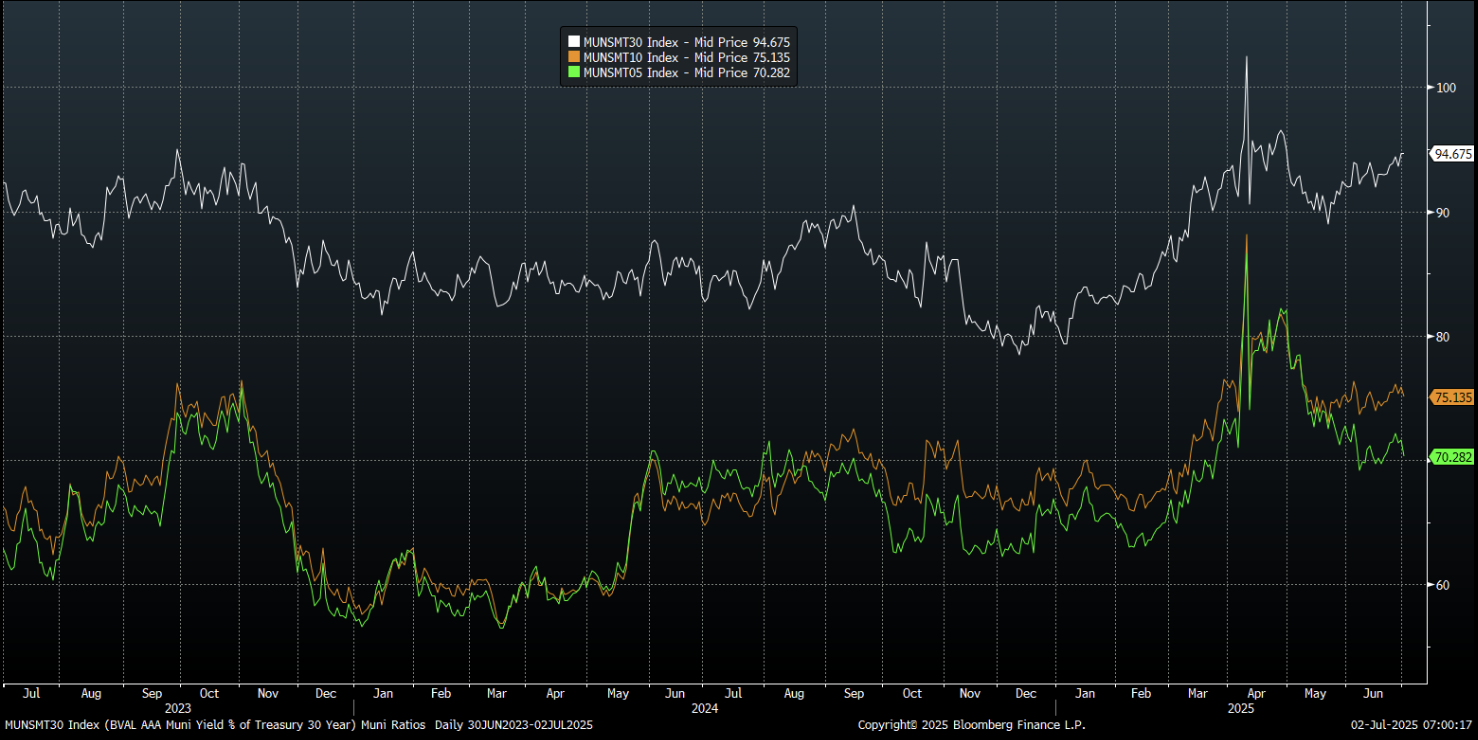

Municipal Bonds: The Unsung Heroes

Municipal bonds are the domestiques of a well-built portfolio—the support riders who shield the leaders from wind, absorb attacks, and do the heavy lifting that enables overall victory. With multiple headwinds facing the market, municipals provide valuable ballast and currently offer compelling value. In the first half of the year, municipal bonds underperformed the broader fixed income market despite strong fundamentals: state and local tax revenues remained healthy, and credit quality continued to improve. The primary culprit was an oversupply of new issuance, as issuers rushed to market in anticipation of a perceived—though unlikely—threat that tax-exempt status could be eliminated in the latest spending bill. We expect this supply-demand imbalance to ease in the second half of the year, creating a favorable environment for municipal bond valuations to recover. For long-term investors, this sets the stage for attractive total return potential with meaningful tax-advantaged income.

Source: Bloomberg

Today, tax-exempt municipal bonds are offering yields near those of equivalent taxable Treasuries—an unusual and attractive situation. For example, a 30-year AAA-rated muni yielding 4.90% equates to roughly an 8.25% taxable equivalent yield for clients in the highest federal bracket. In our view, this presents a far better risk-adjusted investment than paying $2 for $1 of Bitcoin.

Final Thoughts

As we enter the final stages of this economic “race,” the temptation to sprint ahead is strong. But lasting success—whether in cycling or investing—comes from discipline, strategic patience, and strong fundamentals. While the headlines may celebrate the sprinters of today, we remain focused on positioning our clients to win the yellow jersey in the long run.

As always, we appreciate your trust.

Manhattan West Asset Management, LLC (“MWAM”) is an SEC registered investment adviser located in California. MWAM may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. This summary should not be construed by any

consumer and/or prospective client as MWAM’s rendering of personalized investment advice. Any subsequent, direct communication by MWAM with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For information pertaining to the registration status of MWAM, please contact the United States Securities and Exchange Commission on their web site at www.adviserinfo.sec.gov. A copy of MWAM’s current written disclosure brochure discussing MWAM’s business operations, services, and fees is available upon written request.