Ever since prediction markets entered the American mainstream in the fall of 2024, their rapid adaptation reflects something deeper than a novelty. The success of the prediction market space has revealed a powerful mechanism: extracting scattered information and aligning incentives so that truthful beliefs surface, even if they are unpopular.

Information Aggregation: Why Markets Can Predict Better Than Experts

A study found that, across the five United States presidential elections between 1988 and 2004, prediction markets provided a more accurate estimate of the voting result than 74% of the studied opinion polls.

How can a group of diverse, independent people outperform individual expert analysts?

Market predictions succeed not because each individual is smarter, but because of the information people may be unwilling or unable to say directly. The “wisdom of crowds,” a term coined by James Surowiecki, describes how a group of strangers can be more accurate than seasoned professionals by properly aggregating the information.

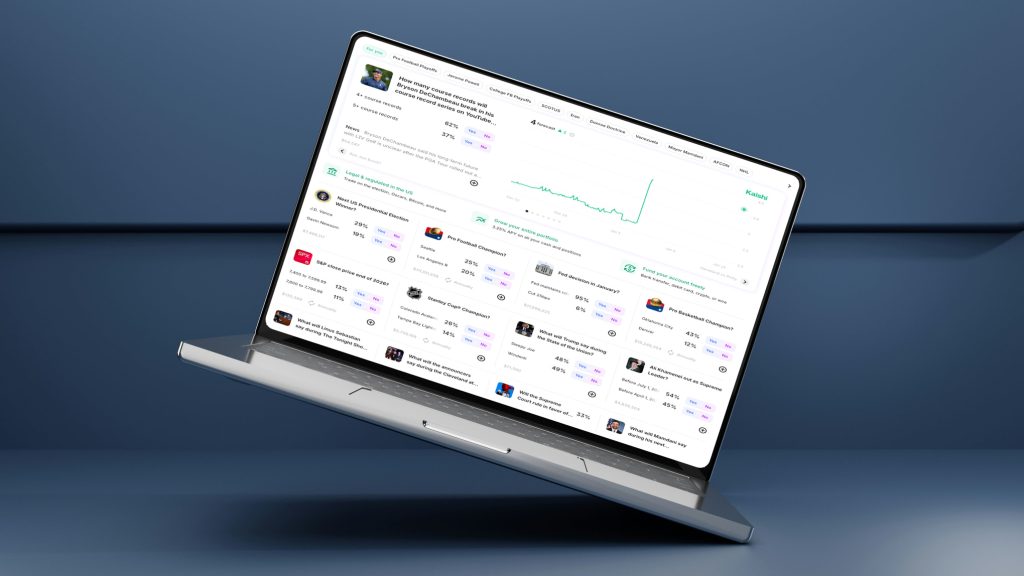

Prediction markets operate on a simple but impactful premise: individuals possess limited, fragmented, and often private information. When participants are rewarded for honesty, markets aggregate the fragments into a single probability sign that often outperforms polls, surveys, and so-called experts.

Incentives Matter: Why Markets Reveal What People Actually Believe

The distinctive feature of prediction markets is the alignment of incentives. Participants are rewarded for being right, not for being agreeable or loud, not by what they hope will happen. By offering anonymous participation, reputation risk is reduced.

This simple structure transforms subjective opinions into objective signals.

Corporate Prediction Markets: Internal Knowledge, Externalized

Prediction markets are not a new concept. Forward-thinking organizations have created and deployed internal prediction markets for over 30 years to surface hidden insights, improve decision-making, and ensure capital allocation.

Corporate prediction markets work like this: Employees and, potentially, outsiders make their guesses over the Internet using virtual currency, polling anonymously. They guess on what they think will actually happen, not what they hope will happen or what the boss wants.

Booming Electronics Retailer: In 2006, a booming electronics retailer’s annual revenue was estimated at ~$33.7B, and it conducted an employee-only internal experiment that correctly predicted that a new store in Shanghai would not open on time. “The potential is that prediction markets may be the thing that enables a big company to act more like a small, nimble company again,” said Jeffrey Severts, a vice president at the booming electronics retailer, who was later quoted.

Large International Hotel Chain: In 2007, a large international hotel chain with over 3,500 hotels spanning 100 countries ran an internal prediction market with 1,000 technical and analytical employees using virtual tokens. The premise was simple: green tokens backed strong ideas and red tokens flagged weak ideas. The hotel chain reported that it has initiated projects driven by the market’s highest-confidence ideas, including enhancements to website search and booking functionality.

Leading Tech Company: Over a three-year experiment in the 1990s involving a dozen prediction rounds, the company discovered that its internal prediction market outperformed the finance department’s official forecasts 75% of the time.

Reflecting on the period, a senior executive who would later become CEO of the $16.4 billion company remarked that had the organization understood then what it knows now, it could have been three times as productive.

Global Medical Tech & Pharmaceutical Diagnostics Conglomerate: Prediction style workshops were used to internally evaluate employee ideas for new healthcare software. Their process revealed new ideas and the strength of employees’ collective belief in them. The outcome included new patents filed and projects launched directly from market-ranked concepts.

Looking Forward: From Opinions to Probabilities

As complexity increases and centralized forecasting breaks down, prediction markets offer a scalable way to translate decentralized knowledge into decisions. By offering a way for uncomfortable truths to surface without affecting hierarchy or politics, prediction markets are more valuable than just in their prediction results.

Conclusion

Prediction markets succeed not because people are inherently wise, but because they are structured to extract, aggregate, and reward accurate information wherever it exists.

When incentives are properly aligned, truthful beliefs surface, decentralized knowledge is transformed into clear probability signals, and decisions are driven by evidence rather than opinion.