Tariff Portfolio Navigation Strategy:

Navigating Tariffs with Discipline and Purpose

In periods of heightened market volatility—especially those triggered by policy developments such as recent tariff announcements—a measured, long-term investment approach is critical. At Manhattan West, we remain grounded in the principles that have consistently guided us through market cycles. This note provides a strategic framework tailored to different portfolio positions amid ongoing uncertainty, offering guidance for navigating tariffs with clarity and conviction.

Our Core Investment Principles:

We remain steadfast in our philosophy, especially when markets become turbulent:

- Valuation Always Matters: Market dislocations offer rare opportunities to acquire high-quality businesses at attractive prices. Discipline in valuation is the cornerstone of long-term return potential.

- Patience is a Virtue—and a Strategy: We invest with a disciplined two- to three-year outlook, but our preferred holding period is long-term. Timing short-term market moves is rarely productive.

- Discipline Over Emotion: We exit positions when the investment case no longer holds, not based on headlines or sentiment.

- Research-Driven Decisions: Every allocation is underpinned by rigorous fundamental analysis—evaluating operations, industry dynamics, and competitive positioning.

- Capital Preservation First: We favor companies with strong balance sheets to help limit downside risk and protect against permanent capital impairment.

The Pitfalls of Market Timing:

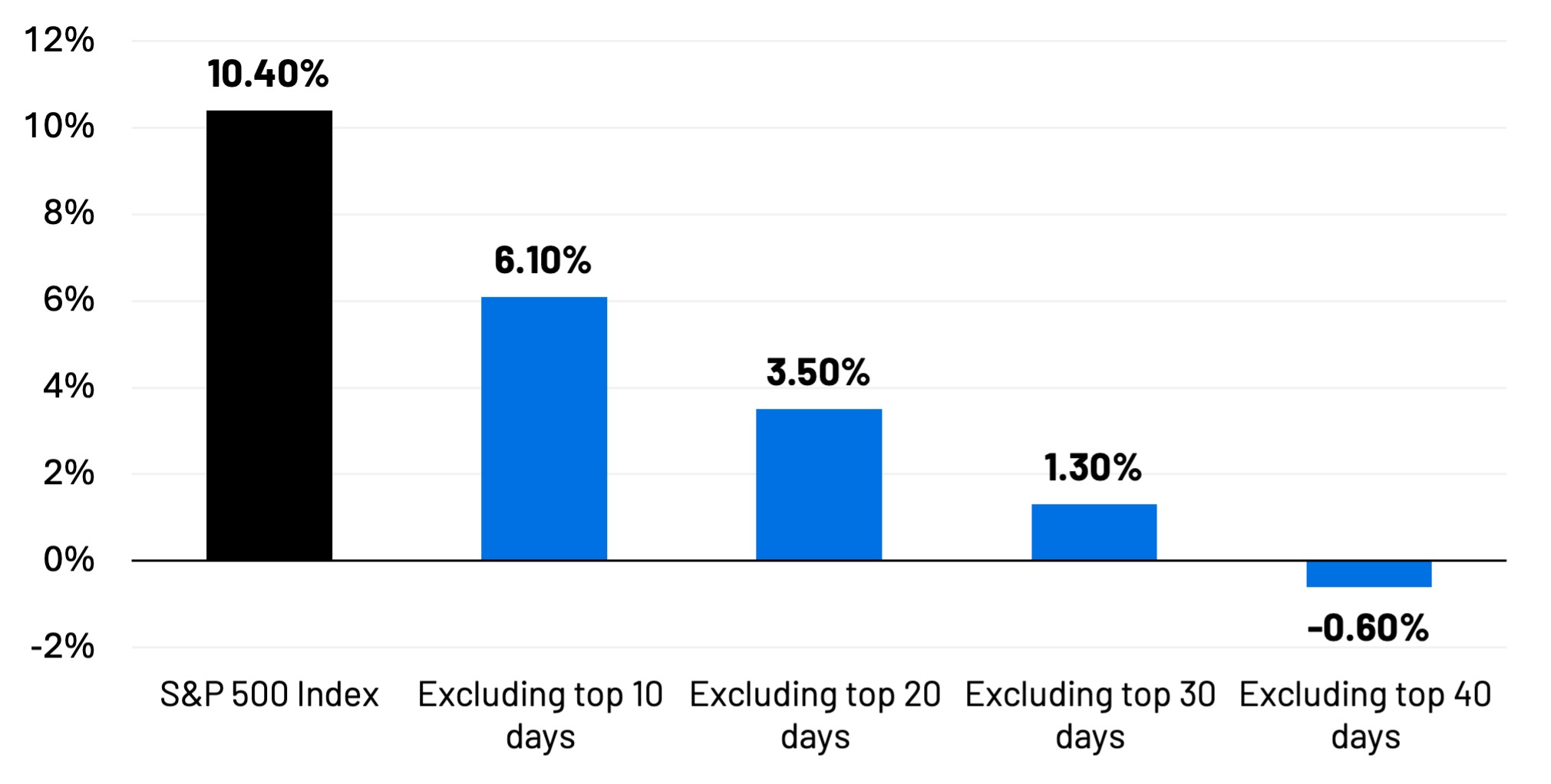

Attempting to exit and re-enter the market in volatile times is rarely successful. Recoveries often begin before the broader economic picture improves—making perfect timing nearly impossible. Historical data shows that being out of the market on even a few of the best days can significantly impact long-term performance.

Annualized Return S&P 500 Index (Total Return)

Let’s Talk Strategy:

In times of market change, a thoughtful review of your investment portfolio is more important than ever. Whether you’re considering new allocations or reevaluating risk exposure, navigating tariffs effectively starts with a disciplined, customized plan.

- Sitting on cash and wondering if it’s the right moment to enter the market?

- Holding bonds and considering a shift toward equities?

- Heavily weighted in U.S. stocks and thinking about enhancing diversification?

We’re here to help you navigate the possibilities. Our personalized approach is designed to align with your financial goals, risk tolerance, and long-term vision.